Financial Capability and Performance: Assessing Trends Among North Carolina Utilities

Of 301 analyzed utilities in North Carolina, 51% reported operating revenues less than operating expenditures — operating ratios (ORs) — less than 1.

Olivia August, Martin W. Doyle, Lauren A. Patterson, Erika Smull

Last Modified Jan 11, 2024

Water affordability and utility financial sustainability are increasing concerns for water management in many industrialized parts of the world (Aspen Institute & Nicholas Institute 2022, AWWA 2021). This is in part because of rising water and sewer rates; a study of the 50 largest US metropolitan areas showed that water and sewer rates increased on average 4.2% annually in the past nine years (Bluefield Research 2021). This trend is expected to continue, considering 64% of surveyed water utilities planned to increase customer water rates in 2021 (AWWA 2021).

When coupled with general stagnation of wages for low-income households, significant rate increases intensify affordability concerns, which are already estimated to affect 12%–35% of households (Cardoso & Wichman 2022, Patterson & Doyle 2021, Colton 2020). More recently, affordability and financial impacts on water and wastewater utilities escalated during the COVID-19 pandemic (AWWA & AMWA 2020), which led to moratoriums on disconnections and $1.1 billion in federal funding as part of the Low-Income Household Water Assistance Program (LIHWAP) in March 2021 (Levine 2021).

Related Topics:

This article was originally published as the cover story in the Jan/Feb 2023 issue of Journal AWWA.

Utility revenue is primarily generated from customer payments for water services, so when a community struggles to afford water services, a utility could potentially generate insufficient revenue to cover its costs.

Water Affordability and Cost Recovery

Utility revenue is primarily generated from customer payments for water services, so when a community struggles to afford water services, a utility could potentially generate insufficient revenue to cover its costs. Indeed, initial measures of affordability by the US Environmental Protection Agency (EPA 1984) were focused on the ability of the utility to afford implementing measures in order to comply with Clean Water Act (CWA) regulations.

Current research on water affordability and utilities has largely focused on the methodologies used to measure and assess water affordability (Teodoro 2018) and financial capability (EPA 2022), or the interventions utilities can employ to address either concern (Rothstein 2021, Doyle et al. 2020). Some analyses have been conducted on trends in customer affordability and utility financial indicators, but they often focus on national comparisons of major cities (Kane 2016).

In the following sections, we empirically explore the link between a utility’s financial health and the ability of its customers to afford their bills. This exploration includes additional factors that may affect a utility’s ability to cover its costs, including the number of customers, the particular demographics of the served population, and other factors that, as of yet, have received surprisingly limited attention.

This analysis considers the financial health of a utility by focusing on cost recovery as measured by the operating ratio (OR), or the ratio of a utility’s operating revenue to its operating expenses, across a range of utility characteristics. The financial capability of a utility was measured using the affordability burden (AB; Raucher et al. 2019), which combines poverty prevalence and the financial burden of low income—i.e., a 20th-percentile income household—to pay for water services.

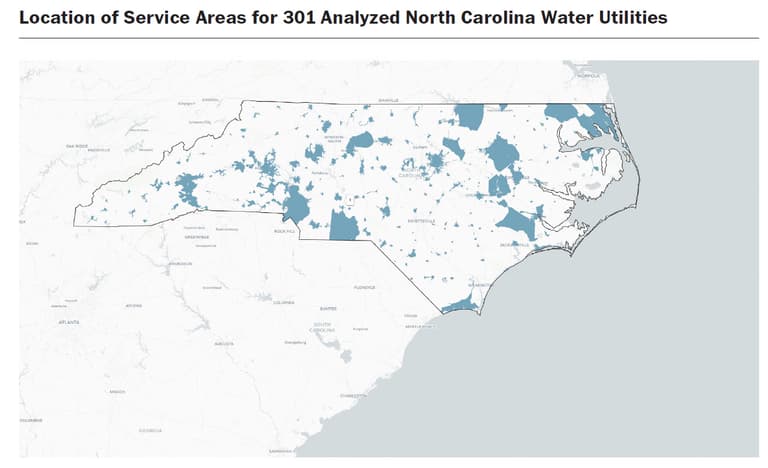

The service areas of the 301 water utilities that were analyzed; many of them provide both water and wastewater services.

This article analyzes financial capability and cost recovery among 301 North Carolina water service providers. North Carolina water utilities provide a diversity of size, income, and population conditions. The results identify a significant and growing group of communities facing a conflicting dilemma of water affordability and utility cost recovery. Many communities have rates that are already considered unaffordable for low-income households and are not generating sufficient revenue to cover expenses, indicated by ORs <1.

We also found that current interventions designed to address household affordability can exacerbate utility cost recovery (and vice versa). For example, raising rates to improve cost recovery generates additional household and community affordability issues. Alternatively, implementing a customer assistance program (CAP) to help low-income households afford their bills often requires significant utility investment, which can impede cost recovery.

Excerpted from the Jan/Feb 2023 issue of Journal AWWA. To read the full article, visit the Journal website.